A COMPOSITE INDEX OF ECONOMIC DIVERSIFICATION IN GCC COUNTRIES

Introduction

The issue of economic diversification has been gaining more interest among international organizations, governments, and policymakers due to its significant relationship with macroeconomic stability, income equality, and sustainable economic growth. Therefore, many resource-rich countries, especially GCC countries, have focused their development plans and national visions on economic diversification as a policy priority for reducing economic volatility and hedging against external shocks, which resulted from the unexpected decline in hydrocarbon prices and the downturn in external demand in the international markets. Overall, more diversified economies are less volatile in terms of output, consumption, export, and investment (IMF, 2018).

In light of the growing importance of economic diversification, this paper aims to assess the overall status of economic diversity in GCC countries and rank them based on their performance in diversifying their economies. To achieve this goal, this research paper proposes to compute a composite index for economic diversification (CIED), based on a subset of indicators that are related to the diversification in production, trade, investment, government revenue, and employment. The constructed composite index will play an important role in policy communication and will provide a quantitative benchmark, which allows for a comparison between the GCC countries by assessing the different dimensions of diversification.

Methodologies Underlying the Composite Indices

Many methodologies are being used in constructing composite indices, such as multivariate analysis, principal components analysis, principle factor analysis, Bayesian model averaging, cluster analysis, and weighted average methods. The choice of the appropriate methodology depends mainly on the purpose of constructing the index, the availability of indicators over a long time series, and the frequency of the indicators. Several researchers employ different approaches to construct a composite index. For instance, Opoku-Afari and Dixit (2012) applied multivariate analysis to estimate a co-incident indicator in Low-income Countries. Furthermore, A. El-mahmah (2017) applied the principle of component analysis to construct an economic composite index for the United Arab Emirates (UAE). Alternatively, Al-hassan, (2009) constructed a coincident index that can closely track the business cycle evolution of the GCC countries by applying the generalized dynamic factor model. Moreover, Freudenberg (2003) used the weighted average method to develop a composite index of innovation performance.

This paper will follow the methodology proposed by Freudenberg (2003), titled “Composite Indicators of Country Performance: A Critical Assessment”, this approach was chosen since it is widely used in the case of comparing the performance of countries on different issues, consistent with the nature of the selected indicators, and their relevance to our case study.

Selecting the Indicators

The composite index of economic diversification is based on the combination and aggregation of indicators from different dimensions. Therefore, the reliability of the index mainly depends on the appropriate selection of indicators. The process of selecting the indicators should be supported by economic theory, literature, and be relevant to economic diversification. This paper relies on five indicators, which measure different dimensions of economic diversification and considered as the driver of economic diversification in GCC countries. The following table presents these indicators:

Table: Selected Indicators, (2000-2022).

| indicator | Weights | Frequency |

| Share of Non-oil GDP in total GDP | 30% | Yearly |

| Share of Non-oil exports in total domestic exports | 25% | Yearly |

| Share of Non-oil revenue in total revenue | 25% | Yearly |

| Share of foreign direct investment in total GDP | 10% | Yearly |

| Economic complexity index | 10% | Yearly |

Weighting the Indicators

The selected indicators have to be weighted before computing the composite index; this step reflects the relative contribution, importance, and reliability of the selected indicators. Therefore, the weights given to indicators significantly influence the result of the composite index.

In many composite indices, such as in innovation composite index and environmental sustainability index, indicators are given equal weights (Fredenburg, 2003). In contrast, indicators may be given different weights (e.g. in the case of the human development index and business climate index) based on purely statistical methods or reference to the opinions of experts, who know policy priorities, theoretical backgrounds, and the multiplicity of stakeholders’ viewpoints (Michela, 2005). The revised methodology involves assigning specific weights to indicators based on their relative significance in the field of economic diversification. This refined approach facilitates a more nuanced and accurate evaluation of economic diversification by prioritizing key factors.

Empirical Normalization of the Indicators

Normalization is a simple transformation (re-scaling) of the initial values of the indicators to avoid having extreme values, partially correct for data quality problems and ensure that the volatility of indicators is penalized the weights sum up to unity. In addition, the normalization method should consider the data properties and the objectives of the composite indicator. Many normalization methods can be used to normalize the indicators, such as the categorical scale, standard deviation from the mean, and minimum-maximum method. The indicators in the paper will be normalized based on “minimum-maximum” this method yields indices that range from zero to 100.

Where: Is the normalized value of indicator I in period t; is the value of indicator I in period t; Min () and Max () are the minimum and maximum values of the indicator.

Aggregation of the Composite Index:

Many aggregation methods have been used in computing composite indices from a subset of indicators, such as linear aggregation, geometric aggregation, or aggregated using nonlinear techniques. Each method implies different assumptions and results. For instance, linear aggregation can be applied when all indicators have the same measurement unit and the scale effects have been neutralized (Nardo et al., 2005). Alternatively, (Freudenber, 2003) suggests that in the case of comparing the performance of countries on different dimensions, the aggregation of the composite indices can be based on the following linear equation form:

: is the composite index of economic diversification for a country c.

: is the weight of the indicators, subject to the condition that

and ≤1; i:1,…,n.

: is the normalized value for the indicator i.

This paper will compute the composite index for economic diversification in each country GCC countries based on the above-mentioned approach. Finally, a composite index that assesses the overall status of all GCC countries can be established by aggregating the composite index of economic diversification in each GCC country, according to the following formula:

.

References:

– M. Freudenberg, “Composite indicators of country performance: A critical assessment”, Technology and Industry working paper 16, OECD, (2003)

– M. Opoku-Afari, S. Dixit, “Tracking Short-Term Dynamics of Economic Activity in Low-Income Countries in the Absence of High-Frequency GDP Data”, IMF, WP/12/119.

– A. El-Mahmah, “constructing economic composite indicators for the United Arab Emirates”, Central bank of UAE, 2017.

– M. Saisna, S. Tarantola “State-of-the-Art Report on Current Methodologies and Practices for Composite Indicator Development”, European Commission, 2022.

– E. Goldberg, “Aggregated Environmental Indices; Review of Aggregation Methodologies”, OECD, 2001.

– A. Mclntyre, H. Yun, and K. Wang, “Economic Benefits of Export Diversification in the Small States”, IMF, WP/18/86.

-A. Al-Hassan, “a Coincident Indicator of the Gulf Cooperation Council (GCC) Business Cycle”, IMF, WP/09/73.

– M.Nardo, M.Saisana, A.Satelli, S. Tarantola, “Tools for Composite Indicators Building”, European Commission, 2005.

RESULT OF COMPOSITE INDEX

The Gulf Cooperation Council (GCC) nations are strategically advancing economic diversification initiatives to mitigate their reliance on oil reserves, acknowledging the pressing challenges posed by dwindling resources and volatile prices. These comprehensive endeavors encompass multifaceted approaches aimed at fostering sustainable growth and resilience in the face of economic uncertainties. Central to their diversification efforts are ambitious mega projects such as NEOM and the Red Sea Project, which are underpinned by substantial investments in research and development (R&D), innovation, and artificial intelligence (AI). These investments serve not only to catalyze technological advancement but also to cultivate a robust foundation for future economic sustainability.

Concurrently, the GCC countries are directing significant resources towards infrastructure development, recognizing its pivotal role in supporting economic diversification and enabling the expansion of non-oil sectors. Investments in transportation networks, utilities, and urban planning initiatives serve as critical enablers for the growth and diversification of the economy. Besides, human Capital Development stands as a cornerstone of their strategy, with a strong emphasis on enhancing education and skills development programs to meet the evolving needs of a diversified economy. Through targeted upskilling and reskilling efforts, as well as initiatives to promote entrepreneurship and foster a culture of innovation, GCC nations are nurturing a workforce equipped to drive forward the diversification agenda.

Moreover, the diversification of industries is being actively pursued, with concerted efforts to promote non-oil sectors such as tourism, manufacturing, finance, and technology. Policy incentives and initiatives to attract foreign investment are leveraged to stimulate growth and create employment opportunities across a spectrum of industries. Sustainability and environmental considerations are integrally woven into the fabric of their diversification strategies. Through investments in renewable energy projects, carbon emissions reduction measures, and the adoption of eco-friendly technologies, GCC nations are laying the groundwork for a more sustainable and resilient economy.

Recognizing the imperative of collaboration, the GCC countries are actively engaging in regional partnerships and alliances to amplify the impact of their diversification efforts. By fostering economic integration and cooperation through joint ventures, trade agreements, and cross-border infrastructure projects, they aim to unlock synergies and enhance the collective prosperity of the Gulf region.

In their pursuit of economic diversification, the GCC countries recognize the importance of attracting Foreign Direct Investment (FDI) to bolster non-oil sectors. Through targeted incentives, streamlined regulations, and investment-friendly policies, they aim to create an attractive environment for foreign investors to channel their capital into industries such as tourism, manufacturing, finance, technology, and others. By diversifying their investor base and injecting foreign capital into these sectors, GCC nations can stimulate growth, create jobs, and reduce reliance on oil revenues.

Additionally, the introduction of taxation policies represents a significant shift in the economic landscape of the GCC region. Historically reliant on oil revenues and minimal taxation, GCC countries are now exploring avenues for diversifying their revenue streams through the implementation of taxes such as value-added tax (VAT), corporate income tax, and excise taxes. These taxation measures not only contribute to fiscal sustainability but also incentivize investment in non-oil sectors by leveling the playing field and reducing dependency on oil-related revenues.

To assess the level of economic diversification within each GCC country and across the entire group, we have constructed a composite index. This index comprises five key indicators: Non-oil GDP, Non-oil revenue, Non-oil exports, Non-oil Foreign Direct Investment (FDI) as a percentage of GDP, and the Economic Complexity Index.

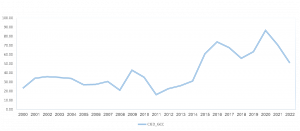

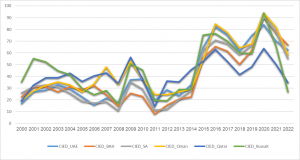

The results of the Economic Diversification Index within the GCC, As indicated by Figure (1), reveals a noteworthy progression, indicating that the concerted efforts towards economic diversification began yielding tangible results as early as 2015. During this period, the index demonstrated significant improvement, reflecting the effectiveness of ongoing initiatives aimed at reducing dependence on oil revenues and fostering a more diversified economic landscape.

Notably, a consistent trend emerges across all GCC member states, As evidenced by Figure (2), underscoring the collective commitment towards achieving economic diversification objectives. This unity of purpose is indicative of the shared recognition among GCC nations of the imperative to mitigate risks associated with overreliance on oil resources and to chart a sustainable path towards economic resilience and growth.

Furthermore, the Economic Diversification Index serves as a comprehensive measure of the extent to which GCC economies rely on oil production, exports, and revenues. For instance, an in-depth examination of the data for the year 2022 reveals a decline in diversification levels. This decline can be attributed to a concerted effort among GCC countries to increase oil production in alignment with OPEC+ policies aimed at stabilizing oil markets. Consequently, this uptick in oil production resulted in a higher share of the oil sector in the overall economy, accompanied by increased revenues and exports driven by favorable international oil prices.

This nuanced understanding of the interplay between economic diversification efforts and oil-related policies underscores the complexities inherent in the region’s economic landscape. It highlights the need for a balanced approach that acknowledges both short-term imperatives and long-term strategic objectives in promoting economic resilience and sustainability within the GCC.

Figure (1): Economic Diversification Index for each GCC country.

Figure (2): The Economic Diversification Index within the GCC Group.